Streamlining Financial Data for Nonprofits

TL;DR: This case study covers the Keela and Aplos integration project, which automates financial data syncing for nonprofits, cutting down on errors and manual work.

—————

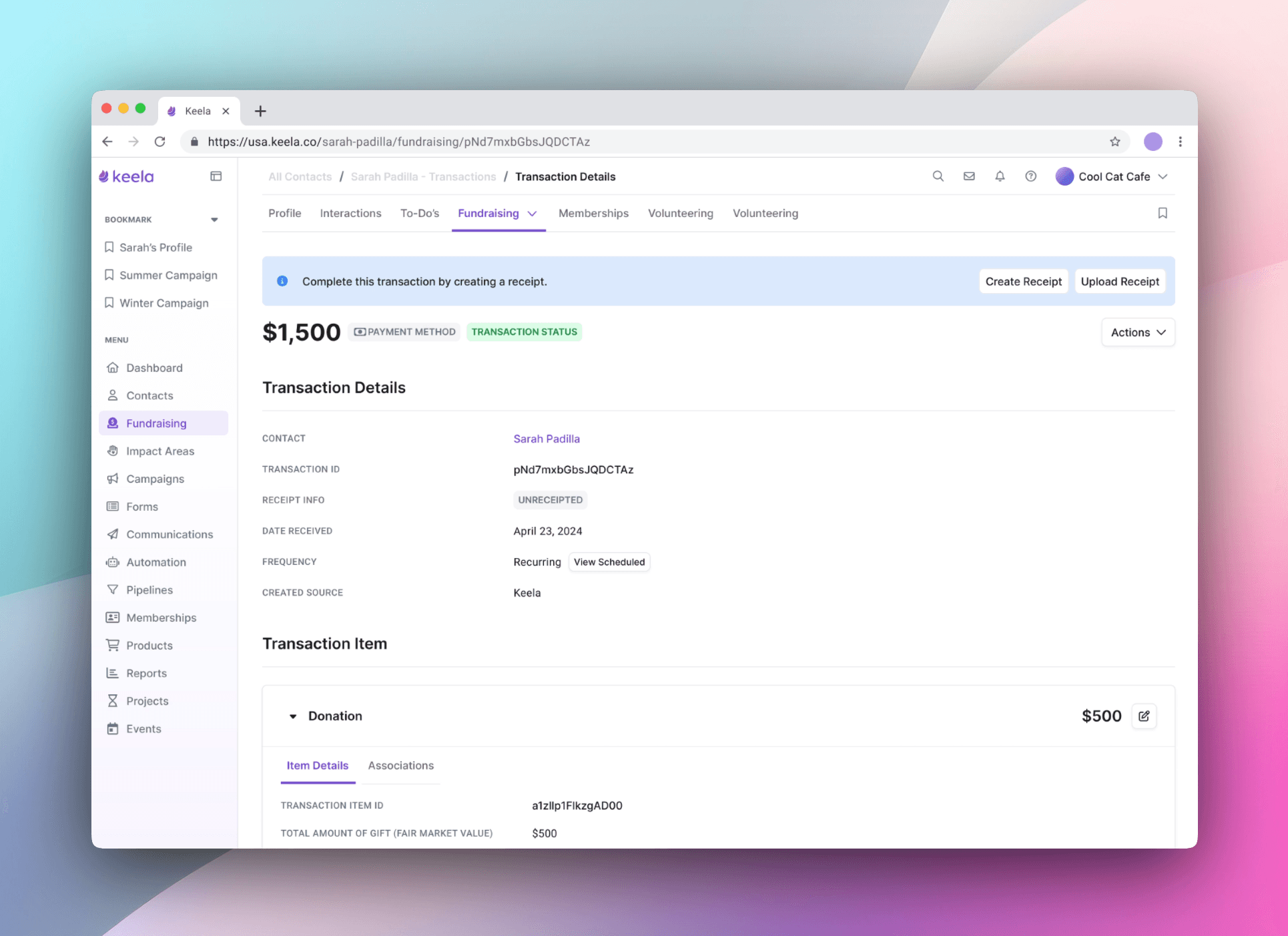

Nonprofits using Keela and Aplos struggled with financial management because their fundraising data (Keela) and accounting systems (like Aplos) weren’t connected. This led to errors, extra manual work, and inaccurate financial reporting. One of the biggest challenges was making sure data fields matched or had the right workarounds to keep everything flowing smoothly between the two platforms.

Outcome

Streamlined Financial Workflows and Business Impact

This integration is designed to automate data synchronization, cutting manual data entry by up to 90% (manual entries are still required as there are offline transactions from cash, securities, and such) and reducing financial errors like duplicates or missing transactions. By streamlining workflows, it frees up significant hours for accountants and prospects, ultimately improving efficiency and accuracy across both platforms.

Process

Research Insights

Our research has highlighted several key requirements. Flexibility in mapping and syncing processes is critical for reducing friction and making workflows smoother. This includes customization options for mapping different fields and handling various criteria. Users also need the ability to review certain data transactions before they sync to catch and prevent errors. Lastly, a streamlined integration and migration process is essential to ensure all financial data transfers properly.

Key Features

The integration will introduce several important features. First, authentication via oAuth will make it easy for users to securely connect their Keela and Aplos accounts from either platform.

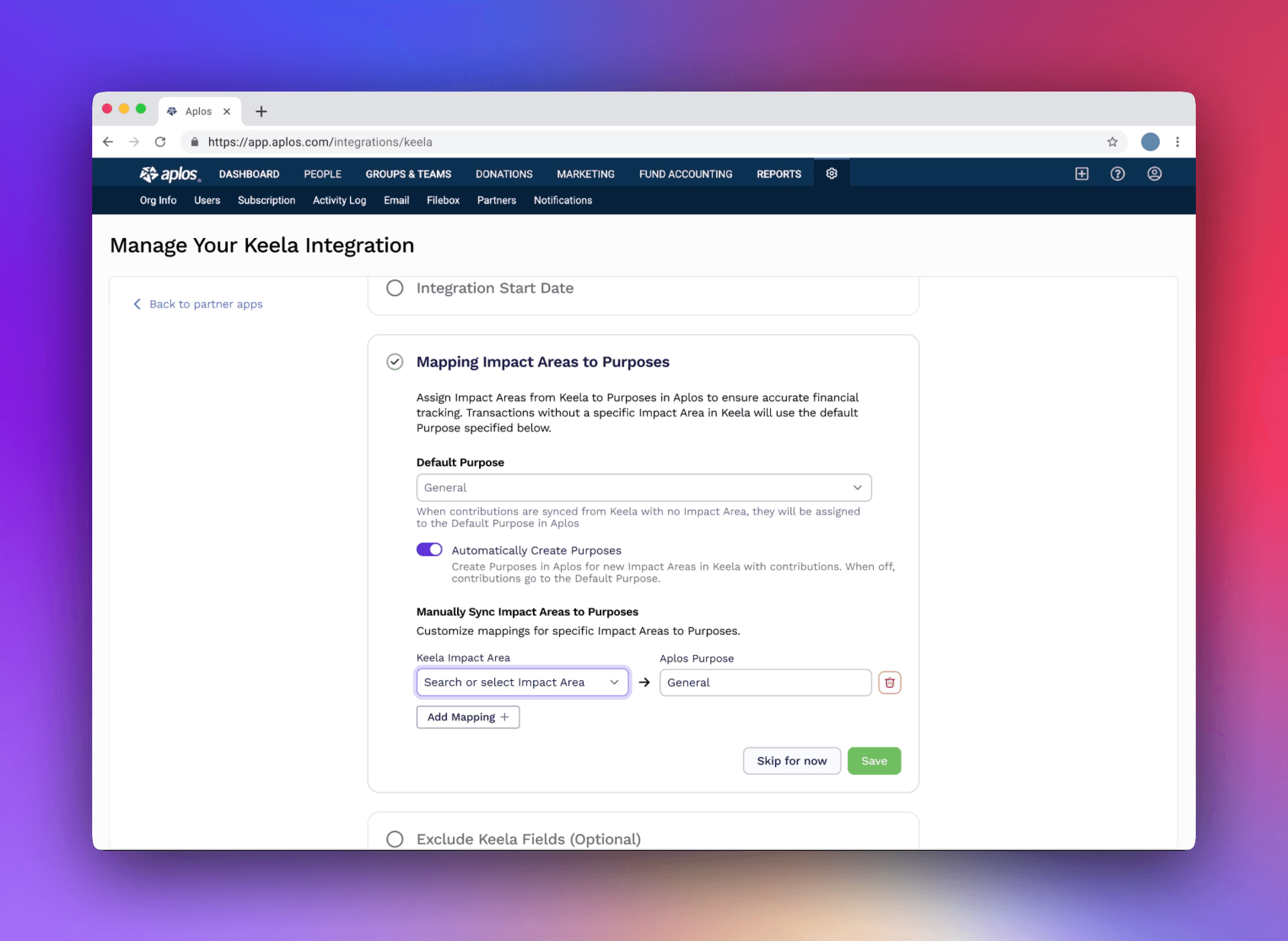

A sync setting within Aplos will allow users to map transactions, specify which asset and expense accounts to use, exclude certain transactions if needed, and match Keela Impact Areas with Aplos Purposes. The core functionality will enable automated, real-time, one-way syncing from Keela to Aplos. Additional enhancements include two-way syncing for select fields, the introduction of new fields and statuses, and a manual sync option in Keela for exceptions or corrections.

Success Metrics

The success of this integration will be measured by several key factors. One is cross-selling impact, tracked by the number of Keela customers adopting Aplos (and vice versa). Another is a reduction in errors related to contact matching and transaction duplication. Customer satisfaction and feedback will be monitored through surveys, while overall efficiency improvements in reconciliation processes will also be a key indicator of success.